How to Build a Profitable Mean Reversion Strategy Using the IBS Indicator in WealthLabPublished: 12/2/2025

|

Understanding the Internal Bar Strength (IBS) Indicator

If you're looking to capture short-term market movements while benefiting from the stock market's long-term uptrend, the Internal Bar Strength (IBS) indicator deserves your attention. This powerful yet simple oscillator has demonstrated impressive results, delivering over 300% returns in the past decade when applied to QQQ (the Nasdaq-100 ETF).

What Is the IBS Indicator?

The IBS measures where a security closes relative to its daily range. It outputs values between 0 and 100:

- Low IBS values (near 0): The close was near the day's low

- High IBS values (near 100): The close was near the day's high

This metric reveals short-term oversold and overbought conditions, helping traders identify optimal entry and exit points for mean reversion strategies.

The Trading Strategy Explained

The beauty of this strategy lies in its simplicity and systematic approach to capitalizing on market inefficiencies.

Entry Rule

Buy when IBS crosses below 10 at the open of the next trading day. This signals that the market closed very near its low, suggesting potential for a bounce.

Exit Rule

Sell when IBS crosses above 90 at the open of the next trading day. This indicates the market closed near its high, signaling it may be time to take profits.

The Philosophy Behind It

Buy-and-hold investing can make you wait years before seeing substantial profits. During that time, numerous short-term opportunities pass by untapped. The IBS strategy allows you to systematically capture these movements by buying weakness and selling strength.

Watch the full video here!

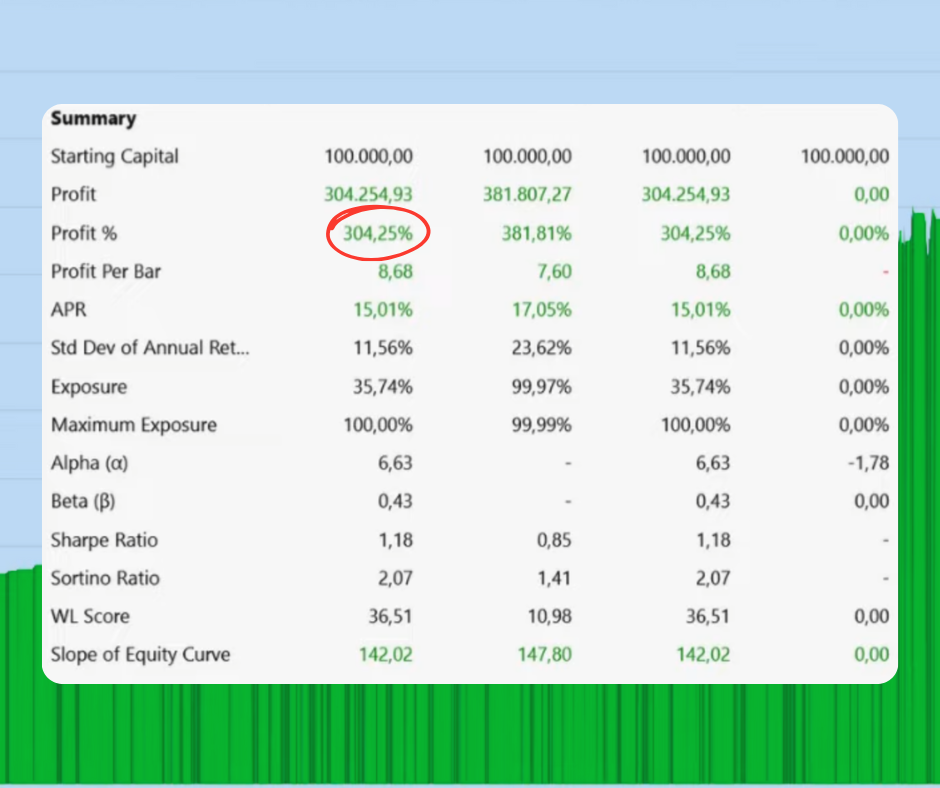

Impressive Performance Metrics

Testing this strategy on QQQ over a 10-year period reveals compelling results:

- Total Return: 300% profit on a $100,000 initial investment

- Average Annual Return: 15%

- Win Rate: 74% of trades were profitable

- Average Profit Per Trade: 0.9%

- Total Trades: 164 over 10 years

- Market Exposure: Only 36%

That last metric is particularly noteworthy—you're only invested about one-third of the time, significantly reducing your market risk.

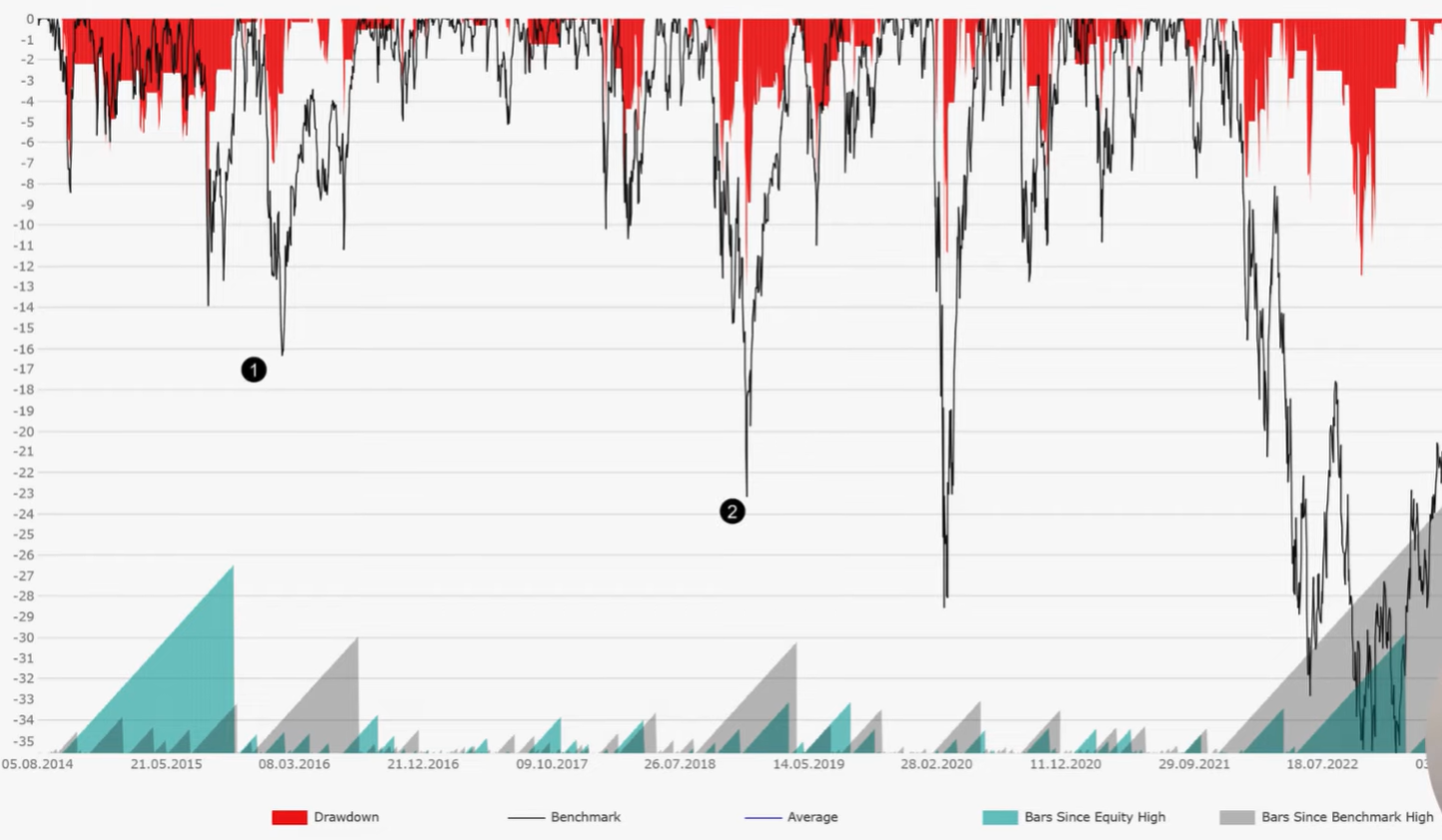

Managing Risk: The Pain Level Advantage

One of the most compelling aspects of this strategy is how it manages drawdown—the maximum loss you experience during an investment period.

When comparing the strategy's drawdown to a buy-and-hold approach:

- Buy-and-hold drawdowns: Substantial losses during market corrections, often exceeding 20-30%

- IBS strategy drawdowns: Rarely exceed 6-7%

This lower "pain level" means you can sleep better at night while still capturing strong returns.

Setting Up the IBS Strategy in WealthLab

Ready to implement this strategy? Here's your step-by-step guide:

Step 1: Create Your Strategy Building Blocks

- Open a new strategy in WealthLab

- Click on "Building Blocks"

- Select "Indicator Crosses Value"

Step 2: Configure the Buy Signal

- Place this block on top of the "Buy at Market" plug

- Change the indicator to IBS

- Keep the period at the default setting of 1

- Change "crosses over" to crosses under

- Set the value to 10

Step 3: Configure the Exit Signal

- Repeat the process for the exit position

- Keep the indicator as IBS

- Change the setting to crosses over

- Set the value to 90

Step 4: Optimize Your Strategy Settings

In the strategy settings panel:

- Symbol: QQQ

- Time Frame: Daily

- Backtesting Period: 10 years

- Position Size: 100%

Key Takeaways for Successful Implementation

The Benefits

- Systematic approach removes emotional decision-making

- Low market exposure reduces overall risk

- High win rate provides consistent profits

- Manageable drawdowns compared to buy-and-hold

Important Considerations

While this strategy has performed well historically, remember that buy-and-hold investors can experience long waiting periods before seeing profits. The IBS strategy addresses this by actively seeking short-term opportunities, but it requires discipline and patience to follow the rules consistently.

Why This Strategy Works

The IBS capitalizes on a fundamental market behavior: prices tend to revert to their mean after extreme moves. By buying when prices close near their lows and selling when they close near their highs, you're positioning yourself on the right side of these natural market rhythms.

Taking the Next Step

The IBS indicator offers a straightforward yet effective way to trade market inefficiencies systematically. With clear rules, strong historical performance, and manageable risk, it's an excellent strategy for traders looking to move beyond simple buy-and-hold approaches.

Remember the golden rule: Test smart, trade smarter. Always backtest any strategy thoroughly on your chosen instruments and timeframes before committing real capital.

Ready to Put This Strategy Into Action?

Don't let another profitable opportunity pass you by. WealthLab gives you the power to backtest, optimize, and automate strategies like the IBS system—all with professional-grade tools designed for serious traders.

Download WealthLab today and start testing this proven strategy:

- Build and backtest strategies in minutes with intuitive building blocks

- Access professional-grade performance metrics and analytics

- Paper trade your strategies before risking real capital

- Automate your trading to remove emotion from the equation

👉 Download WealthLab Now and get started with a free trial

The difference between reading about profitable strategies and actually profiting from them is taking action. With WealthLab's powerful platform, you'll have everything you need to implement the IBS strategy and discover your own winning systems.

Test smart, trade smarter—download WealthLab and transform your trading today.

No Credit Card required.