I would like for an intermarket strategy to divide the Gold future by Oil future (&GC / &CL) and check the RSI value of that.

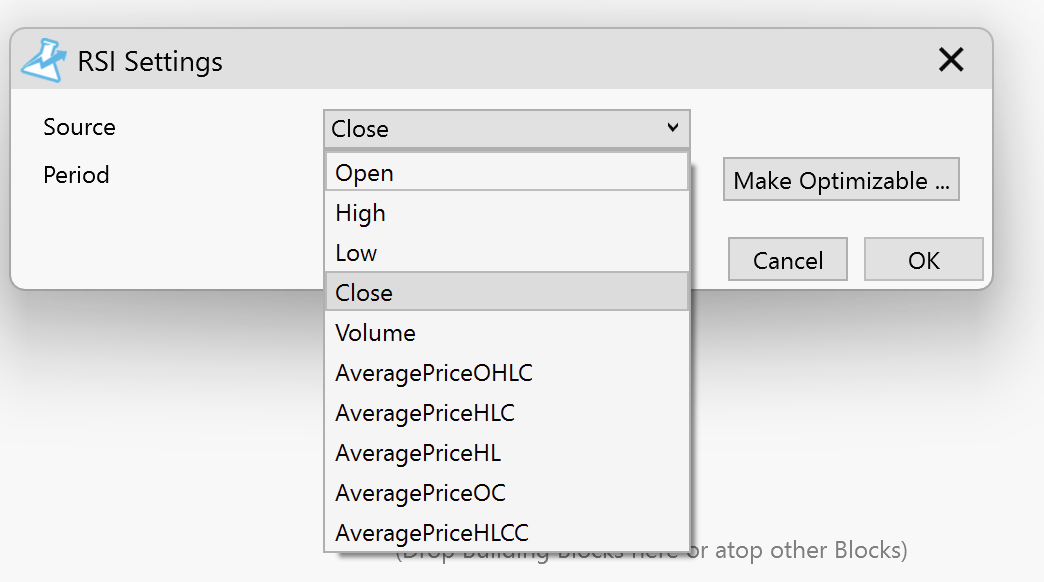

Unfortunately there is no possibility to use a dynamic source field. Close, Volume etc... are hardcoded values in the dropbox.

Or make it better: Use one indicator as an input for another. For example, apply a Moving Average to a Stochastic Indicator, or even to another Moving Average.

Unfortunately there is no possibility to use a dynamic source field. Close, Volume etc... are hardcoded values in the dropbox.

Or make it better: Use one indicator as an input for another. For example, apply a Moving Average to a Stochastic Indicator, or even to another Moving Average.

Rename

Please see the Eval() indicator (part of finantic.Eval extension) and use the SymbolInd indicator in an Expression like:

CODE:

Close / SymbolInd(bars, Close, "CL")

QUOTE:

Or make it better: Use one indicator as an input for another. For example, apply a Moving Average to a Stochastic Indicator, or even to another Moving Average.

Discover the Transformer indicators.

To elaborate, look for MathIndOpInd and IndOnInd in the Transformer Indicators folder. Another option is the third party finantic.Eval as DrKoch mentioned.

@DrKoch:

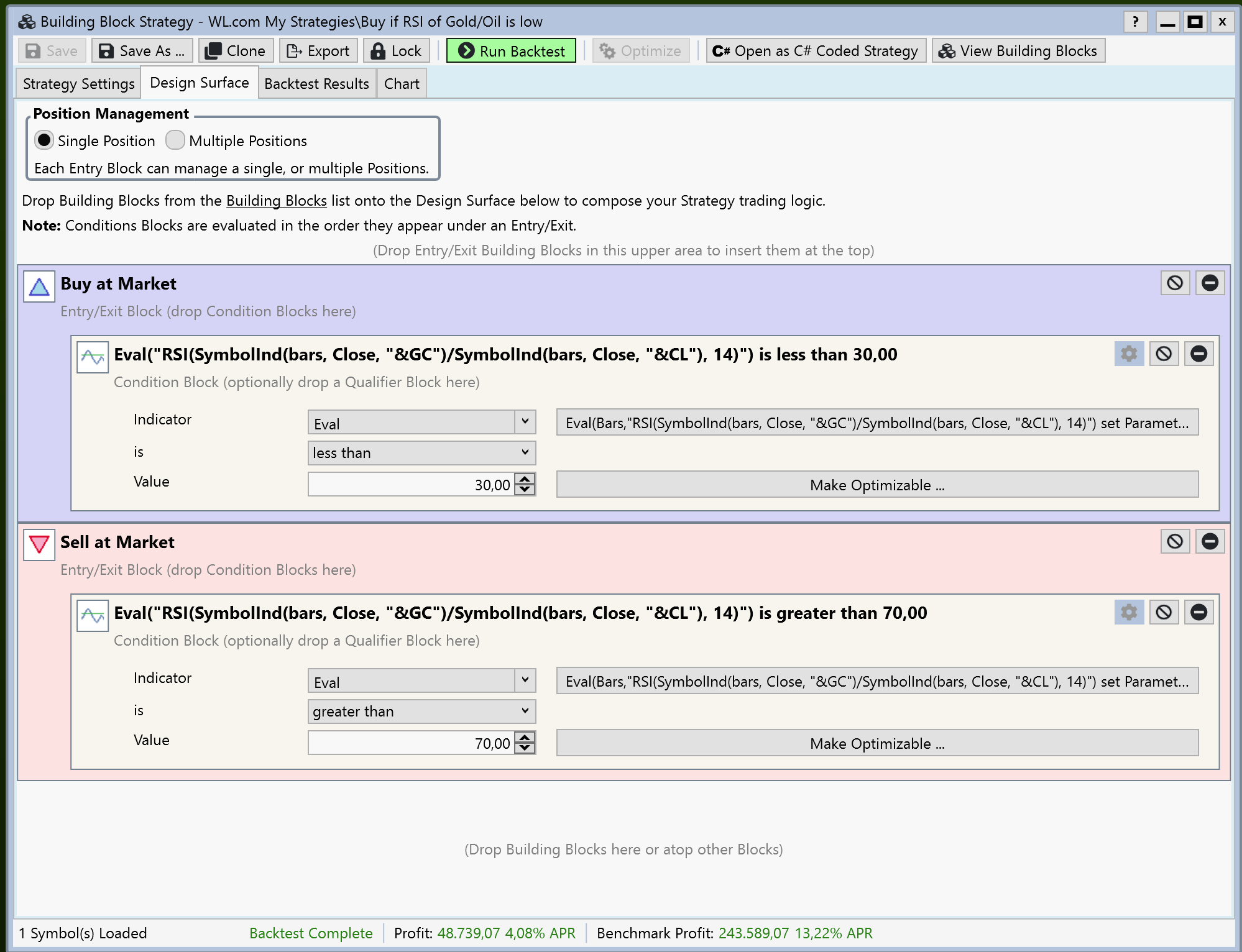

I just bought now the Eval Extension. Thanks it works now:

I just bought now the Eval Extension. Thanks it works now:

:)

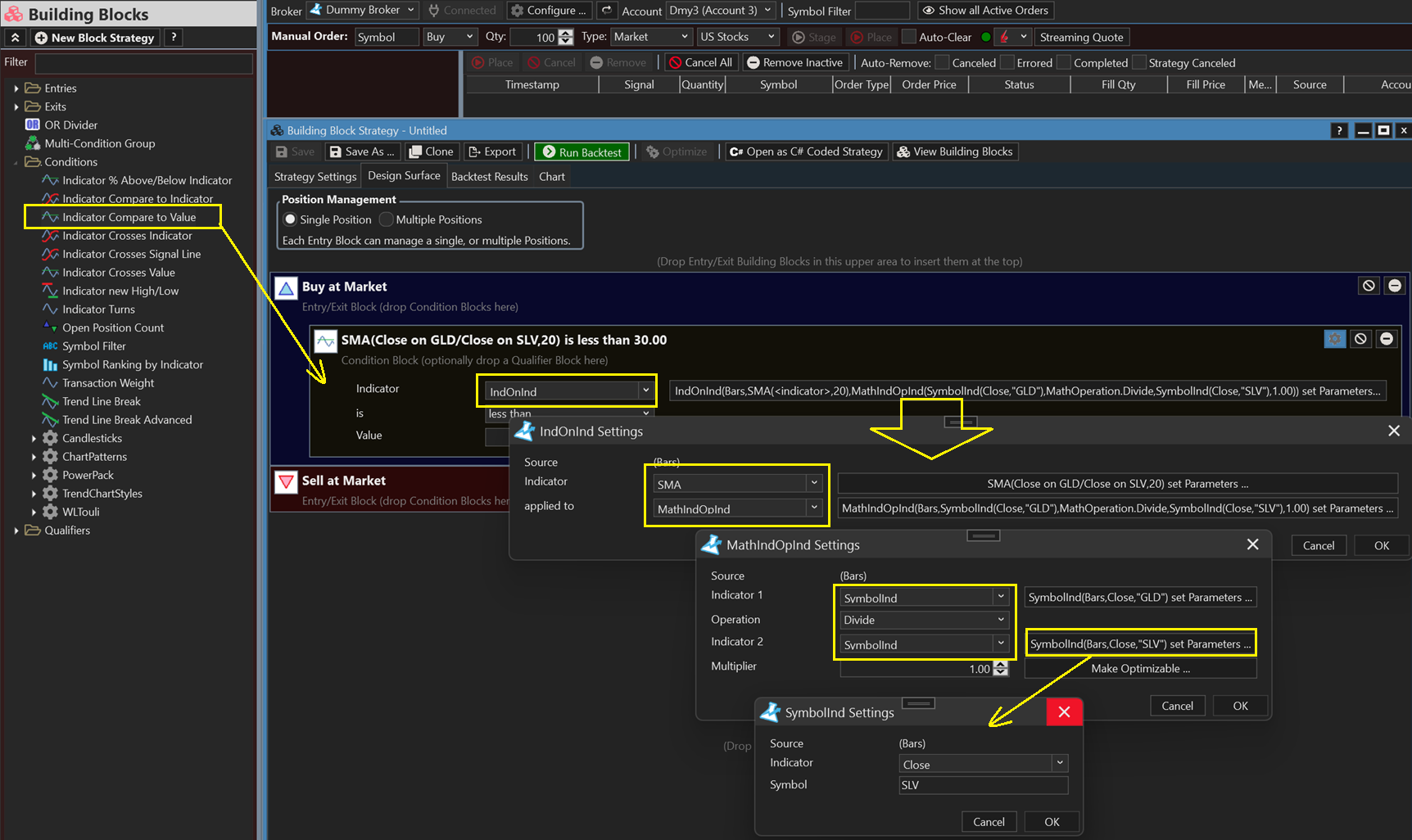

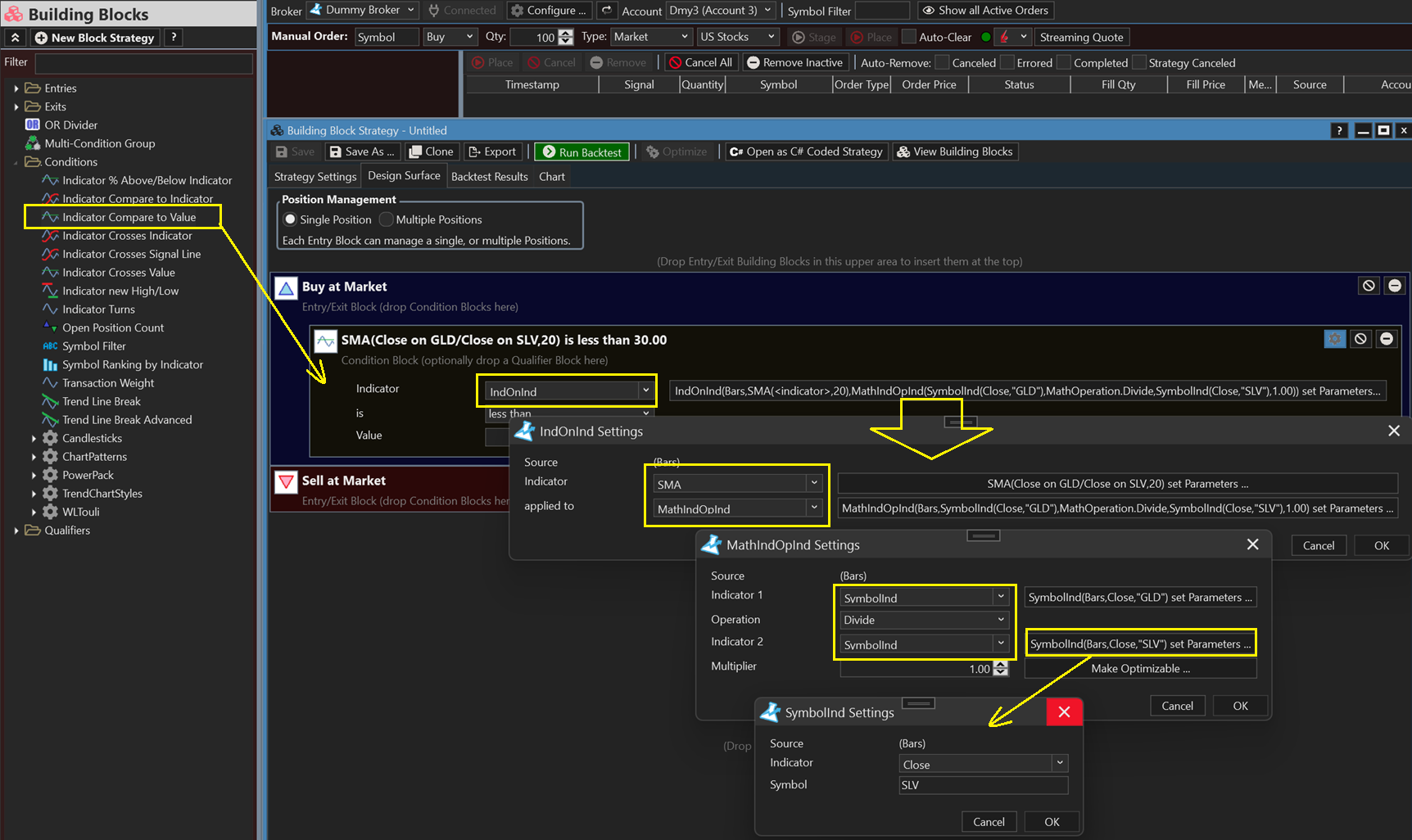

Do you have to get the finantic extension to perform this? I see the Transformer Indicators so curious if anyone could display how to maybe perform a simple GLD/SLV ratio and apply a 20 day moving average to the ratio.

It's the finantic Eval extension and there's an example in Post #4 showing a condition for 14 day RSI of &GC/&CL < 30.

It takes a little work, but like Glitch mentioned in Post #3 you can get there with Transformers too:

It takes a little work, but like Glitch mentioned in Post #3 you can get there with Transformers too:

Any chance you can recreate through building blocks but show how to get the RSI of the difference between 10 week moving average and a 40 week moving average, with a buy at market threshold of 30? Not just for Gold and/or Silver but a database.

Thank you

Thank you

It makes not much sense to calculate an RSI() of a moving average.

(let alone the difference of two moving averages)

Check the definition of RSI() and it will be obvious why this is so.

Also it is (much) better to replace a SMA(10 weeks) by an SMA(50 bars).

Also it is (much) better to replace the difference of two moving averages by the RSL (Reletive Strength according to Levy) or the SROC (smoothed rate of change).

RSL and SROC are equivalent in internal calculations.

I'd suggest you use Indicator Profiler extension or Indicator Selection extension to find indicators or transformed indicators that have a real "edge" instead of playing with arbitrary (and meaningless) combinations.

(let alone the difference of two moving averages)

Check the definition of RSI() and it will be obvious why this is so.

Also it is (much) better to replace a SMA(10 weeks) by an SMA(50 bars).

Also it is (much) better to replace the difference of two moving averages by the RSL (Reletive Strength according to Levy) or the SROC (smoothed rate of change).

RSL and SROC are equivalent in internal calculations.

I'd suggest you use Indicator Profiler extension or Indicator Selection extension to find indicators or transformed indicators that have a real "edge" instead of playing with arbitrary (and meaningless) combinations.

Thank you for the advice and information. Was really just trying to test something that was in Kaufman's "Trading Systems and Methods" book which is pretty extensive as to all things technical and statistical. In the Momentum & Oscillators chapter there is one page where he mentions a method applying the RSI to the difference in the moving averages, the basic MACD calculation. In the graph presented he shows a 5-day RSI applied to 10 and 40 week moving average difference and using the usual 30-70 thresholds, it appears to identify overbought and oversold conditions with little lag, albeit it is only displayed for a short time frame hence the reason I wanted to test it on a longer time frame.

Your Response

Post

Edit Post

Login is required