I've run into a confusing issue. When I run a backtest on my metastrategy, the drawdown is fairly acceptable, ~20%.

However, when I run a Monte Carlo simulation, I'm getting a minimum drawdown of 32% all the way up to 86%, with an average of 52% and a median of 51%.

I'm having a hard time reconciling these discrepancies.

Parameters:

- I'm running a Trade Scramble simulation with 5,000 runs, 100% equity and a 2% skip trade probability.

However, when I run a Monte Carlo simulation, I'm getting a minimum drawdown of 32% all the way up to 86%, with an average of 52% and a median of 51%.

I'm having a hard time reconciling these discrepancies.

Parameters:

- I'm running a Trade Scramble simulation with 5,000 runs, 100% equity and a 2% skip trade probability.

Rename

You didn't say anything about the MetaStrategy settings. Common capital pool? Sizing? Number of strategies?

And 100% of equity sizing for the MC simulation? 1 trade at at time? Why would you do with a set of MetaStrategy trades?

And 100% of equity sizing for the MC simulation? 1 trade at at time? Why would you do with a set of MetaStrategy trades?

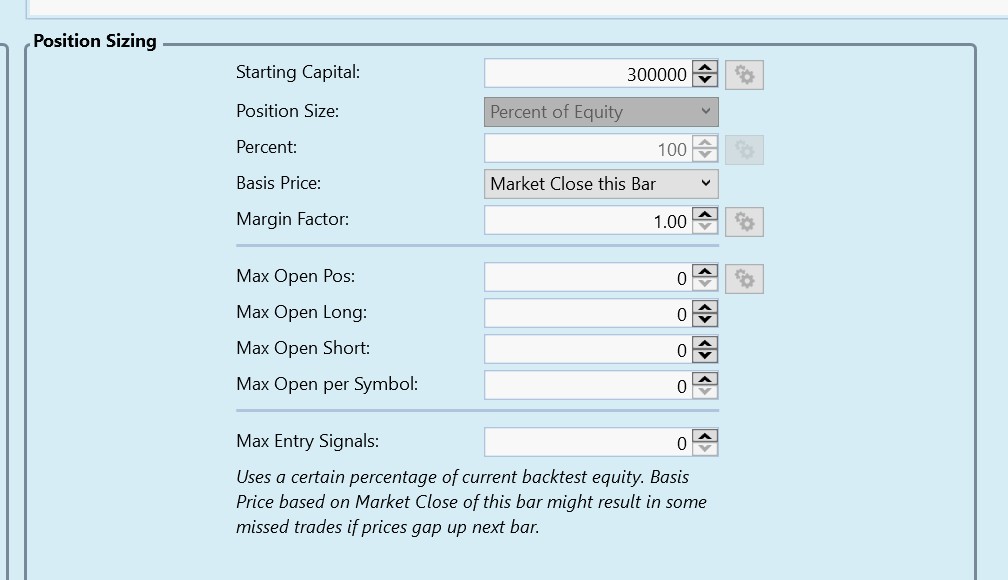

Here are the details - I've also added some screen shots. Let me know if you need something more.

Common capital pool? - Yes

Sizing? - 10% position size

Number of strategies? - 19

And 100% of equity sizing for the MC simulation? - yes, it can hit up to 100%, but only 10% for each strategy

1 trade at at time? - no, the limit on trades is based on the position sizing

Why would you do with a set of MetaStrategy trades? - not sure what you mean by this?

Common capital pool? - Yes

Sizing? - 10% position size

Number of strategies? - 19

And 100% of equity sizing for the MC simulation? - yes, it can hit up to 100%, but only 10% for each strategy

1 trade at at time? - no, the limit on trades is based on the position sizing

Why would you do with a set of MetaStrategy trades? - not sure what you mean by this?

A bit more information:

- 1% or 2% skip trade probability

- this was when I used the "trade scramble" test, including "trade scramble & Randomize"

- when I use the "equity curve scramble" the results are closer to the backtest

- the "basic run" doesn't return any results

- "Same date scramble" returns a drawdown in the 30%-60% range

- "Trade synthesis" is much worse, 42% to 117% range

Hope this helps

- 1% or 2% skip trade probability

- this was when I used the "trade scramble" test, including "trade scramble & Randomize"

- when I use the "equity curve scramble" the results are closer to the backtest

- the "basic run" doesn't return any results

- "Same date scramble" returns a drawdown in the 30%-60% range

- "Trade synthesis" is much worse, 42% to 117% range

Hope this helps

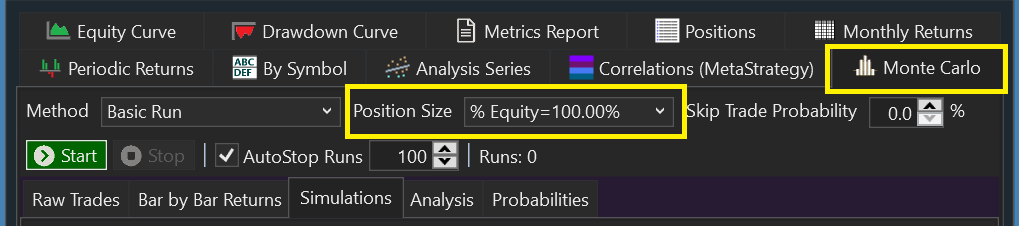

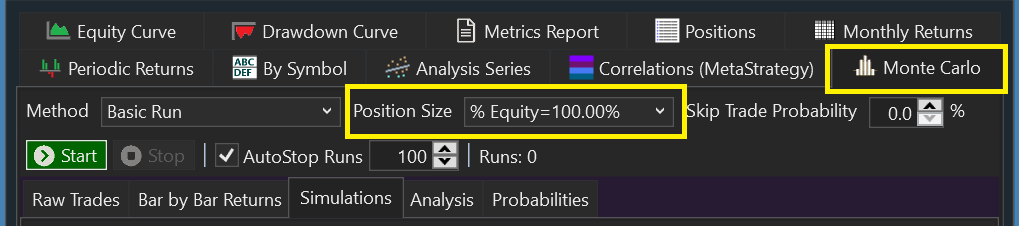

What are the Monte Carlo settings, like Position Size?

You've got 19 strategies, probably all doing their own thing with Position Sizing. Monte Carlo uses only the one sizer in the MC Settings. Most likely, just that is enough to throw off your expectations. (Honestly, I had never thought to apply MC analysis to a MetaStrategy until now; it wasn't designed for it.)

You've got 19 strategies, probably all doing their own thing with Position Sizing. Monte Carlo uses only the one sizer in the MC Settings. Most likely, just that is enough to throw off your expectations. (Honestly, I had never thought to apply MC analysis to a MetaStrategy until now; it wasn't designed for it.)

You nailed it Cone - I had the positions for the Monte Carlo set at 100% instead of 10% like the backtest.

Thanks - all good now!

Thanks - all good now!

And for what it's worth, I find the the Monte Carlo works well with my MetaStrategy.

To be fair, though, each strategy uses the same base logic for individual positions, the difference for each strategy is the trailing stop loss. So that may make a difference in how the MC performs.

To be fair, though, each strategy uses the same base logic for individual positions, the difference for each strategy is the trailing stop loss. So that may make a difference in how the MC performs.

Your Response

Post

Edit Post

Login is required