How does Max Entry Signals affect trades in a But/Sell MOO system? I'm testing a strategy that enter/exit MOO on SP500 and I use percentage based sizer to have max 5 positions of 20% each. Entries are ranked by ROC. What I noticed is that if I increase Max Entry Signals from 5 to 6 then to 10 I got higher APR. Trades were also different.

Why did this happen? I thought in a MOO system with entry ranking, if I allow 5 max positions, then changing Max Entry Signals from 5 to a larger value should not change what get picked because the system should always pick the top 5 based on ranking.

Why did this happen? I thought in a MOO system with entry ranking, if I allow 5 max positions, then changing Max Entry Signals from 5 to a larger value should not change what get picked because the system should always pick the top 5 based on ranking.

Rename

Your thoughts are correct. Looking into it.

What if there is a large gap up in the morning? Certain symbols might not be able to get filled because of insufficient capital. The new symbols you added by increasing Max Entry Signals might be able to get filled in their place. This would result in a different outcome.

That appears to be the case. If you run your 20% sizing backtest with Max Entry Signals set to 0, the result is likely to be the same as if setting it to 10. But anywhere between 5 and 9 could change the outcome because that limits the candidates.

For example, with 20% sizing, it's likely that on any given bar you'll have enough buying power for the first 4 positions. That next one, probably not if it gaps higher. If it does, the backtest will use the next candidate(s) in line - unless there isn't one because of a limited number of Entry Signals.

.. actually, with volatile Nasdaq 100 stocks that tend to gap on the same days, you might need to increase the Max Entry Signals to 20 or more to get the same outcome as 0. You can reduce the effect quite a bit by just allowing the backtest to use some margin, like 1.10 to 1 would be a good setting for 20% sizing.

For example, with 20% sizing, it's likely that on any given bar you'll have enough buying power for the first 4 positions. That next one, probably not if it gaps higher. If it does, the backtest will use the next candidate(s) in line - unless there isn't one because of a limited number of Entry Signals.

.. actually, with volatile Nasdaq 100 stocks that tend to gap on the same days, you might need to increase the Max Entry Signals to 20 or more to get the same outcome as 0. You can reduce the effect quite a bit by just allowing the backtest to use some margin, like 1.10 to 1 would be a good setting for 20% sizing.

That was my thought too so I tried to use next bar open instead of current bar close for sizing. But the results were still different. Also using 10 and 0 for max entry signal gives different results.

I emailed a strategy that you can use to repro to info@wealth-lab.com

I emailed a strategy that you can use to repro to info@wealth-lab.com

Why do you think using next bar open would somehow cause this effect to not happen? It's an expected outcome of what you did.

I thought that will use the next bar open to calculate # of shares so the insufficient capital issue won't happen.

It happens even with a margin factor of 5. How this could be explained?

It happens even with a margin factor of 5. How this could be explained?

Because even with a margin factor of 5 the strategy can still reach 100% exposure depending on how long it holds positions.

The strategy is a weekly strategy so it tends to hold positions long. However from score card I see the max exposure is only ~110% with a margin factor of 5.

You have a lot of conditions in your strategy, and a symbol filter that only includes stocks that are in the top 30% of ROC.

There are points in the strategy where, with max entry signals of 7 versus 6 (etc...) some new symbol is being included that meets your other conditions and is allowed into the backtest where it wasn't beforehand.

There are points in the strategy where, with max entry signals of 7 versus 6 (etc...) some new symbol is being included that meets your other conditions and is allowed into the backtest where it wasn't beforehand.

@Glitch: Do you mean that the ROC filter step come AFTER the max entry signal requirement? That does not make sense to me since how do you know that after the max entry signal filters you'll still have candidate that meet the ROC filter?

I feel that the Max Entry Signals box, as part of position sizing config, should come LAST after all the strategy filters/rankings.

I feel that the Max Entry Signals box, as part of position sizing config, should come LAST after all the strategy filters/rankings.

This happens with fixed amount position sizer too. The only thing I could think of which might cause this is that some stocks have very high price per share so the fixed amount is not enough to buy a single share. But even after i increased the fixed amount to 1 million this still happened.

It comes last.

But if you increase the Max Entry Signals you'll get MORE candidates? Right?

And one of those new candidates might pass through your OTHER conditions while the previous ones didn't.

This will lead to different outcomes depending on what you set for Max Entry Signals.

But if you increase the Max Entry Signals you'll get MORE candidates? Right?

And one of those new candidates might pass through your OTHER conditions while the previous ones didn't.

This will lead to different outcomes depending on what you set for Max Entry Signals.

QUOTE:

But if you increase the Max Entry Signals you'll get MORE candidates? Right?

And one of those new candidates might pass through your OTHER conditions while the previous ones didn't.

Sorry I'm still confused here. I do not understand why changing Max Entry Signals would affect number of candidates generated by the strategy logic. My understanding was that this only cuts the signals generated by the strategy to a given number for each day, and each day the number of signals pass all the entry conditions/filters should remain the same.

If this is the case, then the only way that this could affect trades in a MOO system with ranking is insufficient capital. But the strategy i shared seems to have sufficient capital with a MF of 3 or 5.

What do I miss here?

The first filter are your conditions. This will determine the first group of symbols that might be allowed. This includes your symbol filter condition (top 30% ROC) and your other conditions.

Once the backtester has these symbols, it sorts them by the Weight and takes the Top N based on Max Entry Signals.

Once the backtester has these symbols, it sorts them by the Weight and takes the Top N based on Max Entry Signals.

Thanks Glitch. This is exactly my understanding so there's no gap here. So

1. each day before applying the Max Entry Signal cutoff the signals should be exactly the same.

2. what you said in #9 about changing Max signal affect candidates won't happen right? At least it won't affect the top 5 candidates in my case?

3. If there's no insufficient capital issue, then the list of trades in a MOO system should be the same for any value for Max Entry Signal >= Max allowed positions?

1. each day before applying the Max Entry Signal cutoff the signals should be exactly the same.

2. what you said in #9 about changing Max signal affect candidates won't happen right? At least it won't affect the top 5 candidates in my case?

3. If there's no insufficient capital issue, then the list of trades in a MOO system should be the same for any value for Max Entry Signal >= Max allowed positions?

No, the signals might be different. Here's an example.

Let's say your condition is ROC > 10. And the Weight is RSI.

With Max Entry Signals of 3 you have symbols A, B, and C.

Symbol A and B have ROC > 10 but symbol C does not.

You'll get 2 signals.

With Max Entry Signals of 4 you have symbols A, B, C and D.

Now, D has a ROC > 10 so it is included in the candidates.

You'll get 3 signals.

Let's say your condition is ROC > 10. And the Weight is RSI.

With Max Entry Signals of 3 you have symbols A, B, and C.

Symbol A and B have ROC > 10 but symbol C does not.

You'll get 2 signals.

With Max Entry Signals of 4 you have symbols A, B, C and D.

Now, D has a ROC > 10 so it is included in the candidates.

You'll get 3 signals.

hmm now I'm confused again about the order of filters here :) Seems that Max Entry Signals is applied BEFORE checking for ROC? Otherwise why changing this affects input symbols to strategy ranking/filtering?

With your example my understanding was:

Say the universe is A,B,C,D, and A,B,C have ROC>10, and C has ROC < 10.

When Max Entry Signals=3:

After strategy ranking and ROC filtering: A,B,D

After Max Entry Signals cutoff: A,B,D

When Max Entry Signals=4:

After strategy ranking and ROC filtering: A,B,D

After Max Entry Signals cutoff: A,B,D

With your example my understanding was:

Say the universe is A,B,C,D, and A,B,C have ROC>10, and C has ROC < 10.

When Max Entry Signals=3:

After strategy ranking and ROC filtering: A,B,D

After Max Entry Signals cutoff: A,B,D

When Max Entry Signals=4:

After strategy ranking and ROC filtering: A,B,D

After Max Entry Signals cutoff: A,B,D

Why would C be a signal? It doesn't satisfy the ROC > 10 condition.

@Glitch: Sorry my mistake. it should be A,B,D in both cases. Updated the post.

Well yes in this case the results would be the same, but in the situation I described above they wouldn't.

I'm coming back to this discussion after seeing someone reported another slightly related problem in https://www.wealth-lab.com/Discussion/Ranking-of-Top-N-stocks-conflicts-with-Position-Sizing-12575.

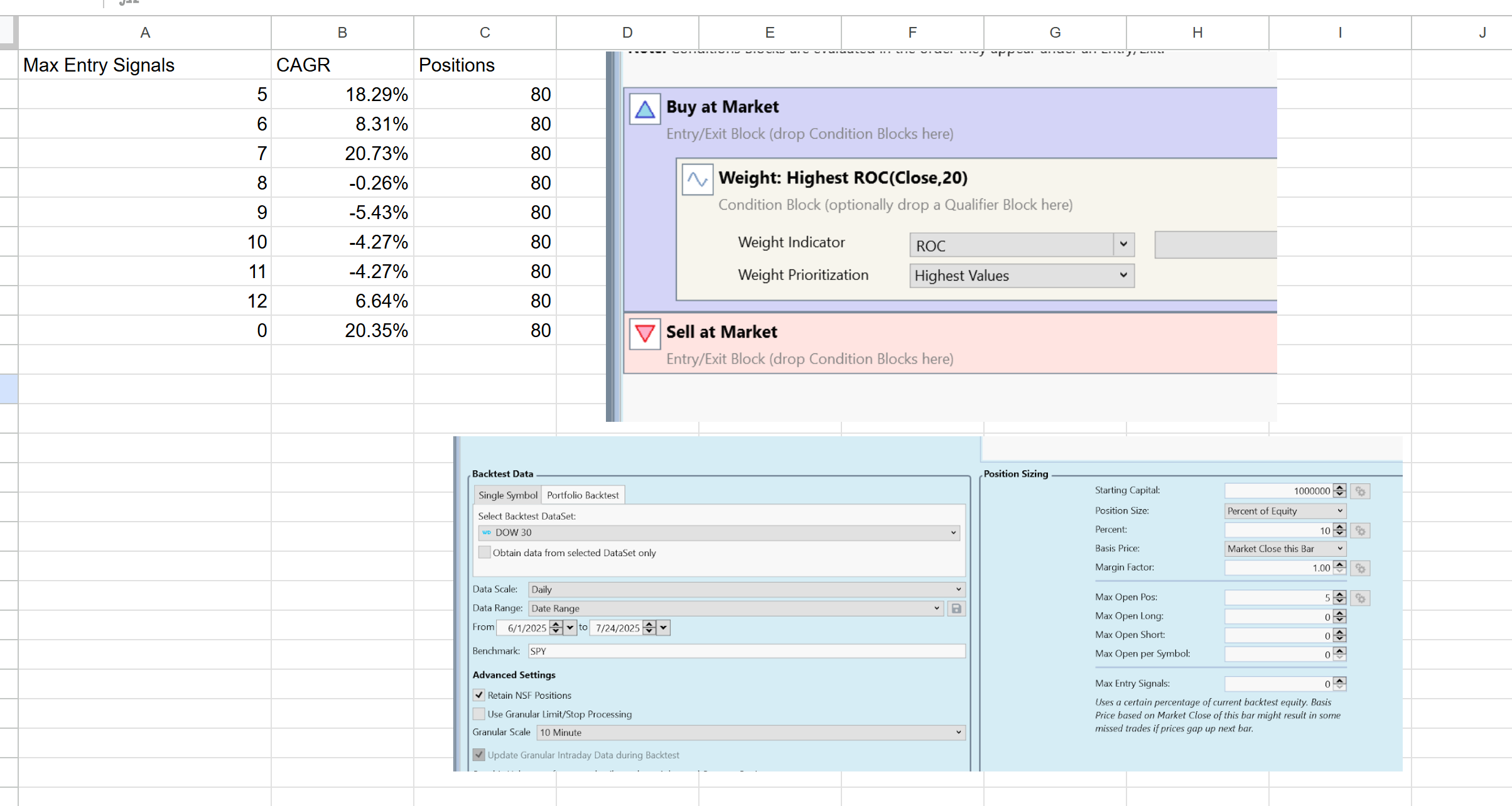

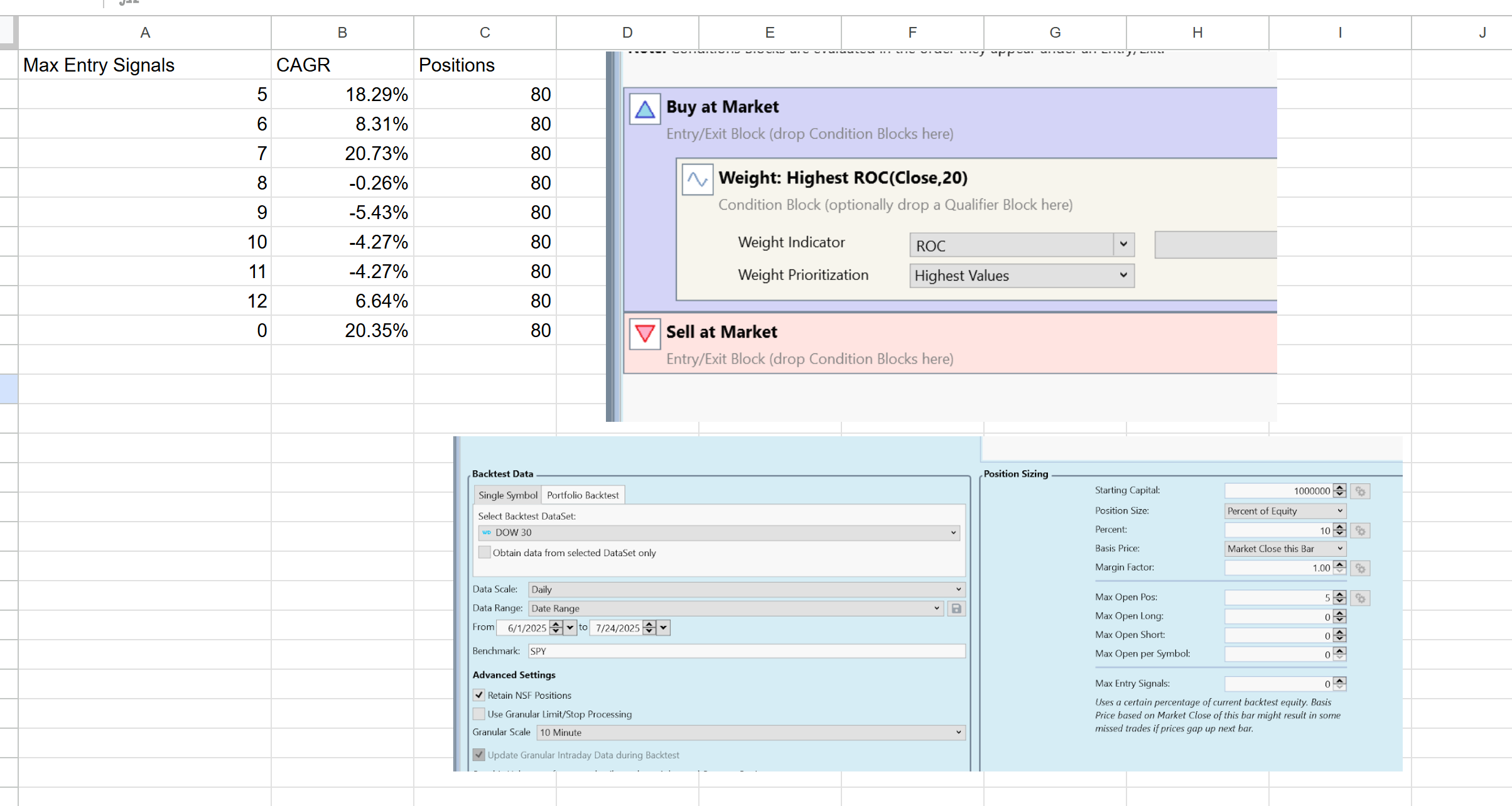

I did some more tests to show this issue. With the simply one day hold strategy in the screenshot, when I changed the max entry signal from 5 to 12 and to 0 (no limit), I got very different results. One thing that @glitch mentioned in the discussion was that when i increased max entry signal I might bring in tickers that could be filled while with a smaller max entry signal, some top signals might not get filled due to gaps, etc. But here you can see the # of positions in all the tests are all the same, and i checked each day there were 5 positions opened for all settings I tested (I used about 50%equity for the test to make sure there's no issues with gaps in the tests : 5 max positions, each with 10% equity). So each day should have the same exactly same positions since signals are ranked. I feel something must be wrong here.

@glitch, @cone thoughts?

I did some more tests to show this issue. With the simply one day hold strategy in the screenshot, when I changed the max entry signal from 5 to 12 and to 0 (no limit), I got very different results. One thing that @glitch mentioned in the discussion was that when i increased max entry signal I might bring in tickers that could be filled while with a smaller max entry signal, some top signals might not get filled due to gaps, etc. But here you can see the # of positions in all the tests are all the same, and i checked each day there were 5 positions opened for all settings I tested (I used about 50%equity for the test to make sure there's no issues with gaps in the tests : 5 max positions, each with 10% equity). So each day should have the same exactly same positions since signals are ranked. I feel something must be wrong here.

@glitch, @cone thoughts?

Your Response

Post

Edit Post

Login is required